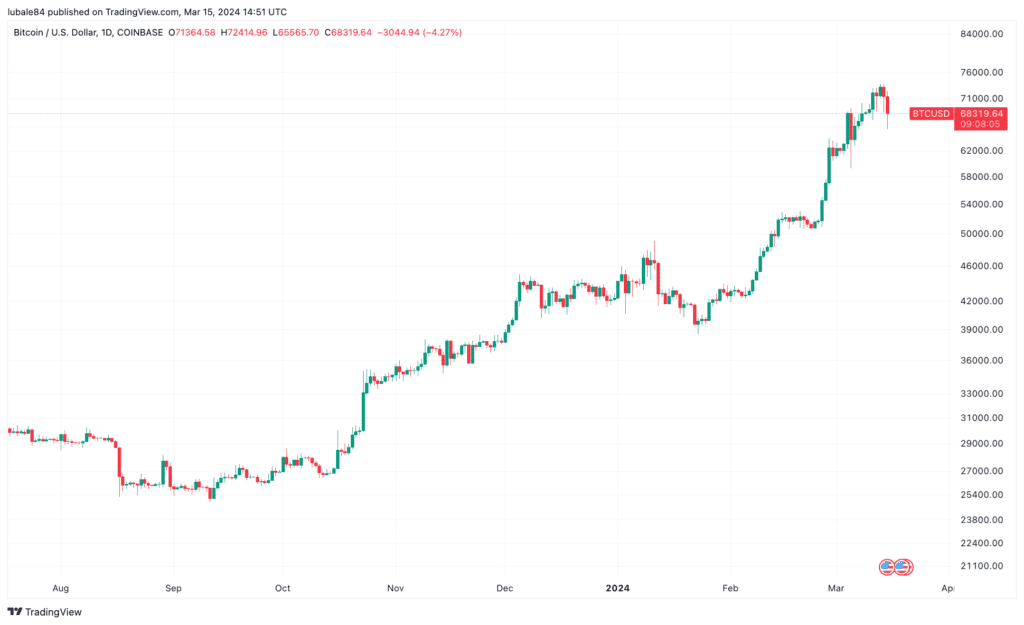

The price of Bitcoin is starting to fall after an incredible rise, and altcoins are following suit quickly. As the cryptocurrency market displays “overheated” conditions, Bitcoin is currently trading at $68,319 on March 15, down 4.5% according to a study from on-chain analytics company IntoTheBlock.

The price of bitcoin decreased from its most recent all-time high of $73,835 on March 14 by 9% to a new weekly low of $65,565 on March 15, according to data from Cointelegraph Markets Pro and TradingView.

According to data from CoinMarketCap, the worldwide cryptocurrency market cap fell 4.1% on the day to settle at $2.59 trillion as a result of the decline in Bitcoin’s price, which has also caused a sell-off throughout the market.

Ether has also decreased by 5% to $3,708 over the past day. BNB, XRP, Cardano’s ADA, and Dogecoin were among the other top-cap coins that flashed red within the same period, losing 2.3%, 7.3%, 5.8%, and 8% of their value, respectively.

The only token in the top 10 cryptocurrencies to show growth was Solana’s SOL, which increased by 8% in the previous day. According to TOBTC, Cointelegraph had previously issued a warning about potential corrections in the price of Bitcoin because of overheated conditions.

Market research firm IntoTheBlock supports this information, showing growing leverage in the cryptocurrency market and suggesting that a correction is coming soon.

Funding rates have reached their highest level since 2021, indicating an overheated market.

IntoTheBlock reports that the “amount that buyers of Bitcoin perpetual swaps pay those going short is at its highest since October 2021” in this week’s On-chain Insights newsletter.

Bitcoin’s “funding rates on Binance and Bybit reached levels of 0.06% and 0.09% yesterday, paid every 8 hours,” according to IntoTheBlock experts, who have noted this in the chart below.

The paper also stated that “these fees translate to an annualized cost of 93% and 168% to go long Bitcoin.”

“The abnormally high funding rates are indicative of a market that skews very heavily on the long side.”

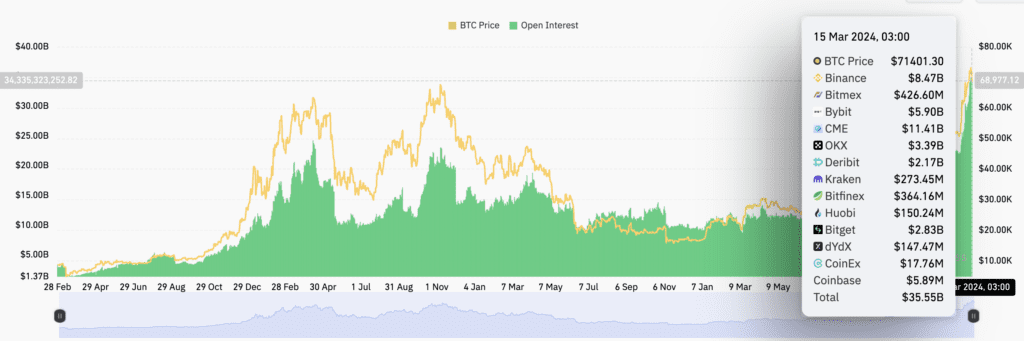

According to additional statistics from Coinglass, on March 15, the open interest (OI) for Bitcoin futures hit a record high of $35.55 billion on all exchanges.

IntoTheBlock experts note that when open interest rises too high, “overly bullish positioning in derivatives posts a warning sign for the market,” even as high OI indicates fresh buying in the market driven by increasing inflows into the spot Bitcoin exchange-traded funds (ETFs).

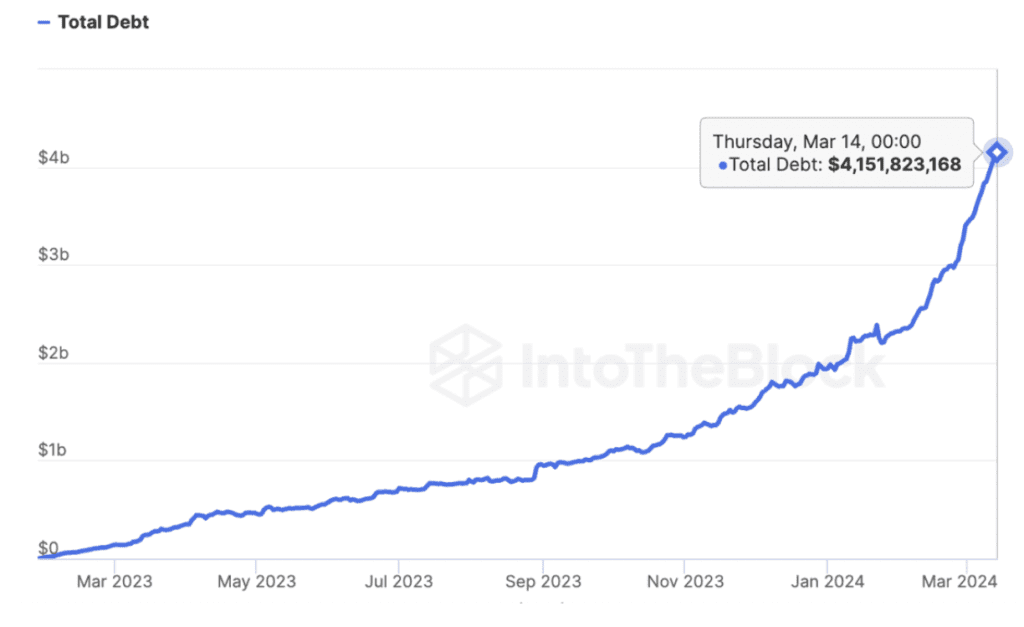

The risk in the DeFi ecosystem is growing too great.

Due to a rapid rise in loans on decentralized finance (DeFi) networks, high-leverage conditions are now outside centralized exchanges.

The following graphic illustrates how, as of 2024, the total debt owed on all DeFi protocols has doubled. Further information from IntoTheBlock indicates that as of March 14, the overall debt had risen from approximately $2 billion at the start of January to $4.15 billion.

“As Bitcoin reaches new all-time highs, crypto investors have begun seeking leverage against their holdings.”

Additionally, the “aggregate amount of debt issued through Aave v3 on Ethereum” has climbed by a factor of 2.14 year-to-date, according to IntoTheBlock.The study also stated that as of 2024, “Aave is receiving more than 10,000 BTC (~$700M) more in wrapped Bitcoin (WBTC).”

This suggests that as the “demand for leverage” has increased, so too have the rates in DeFi.As a result, the company cautions that too much risk is being assumed by the DeFi ecosystem, which might soon cause a price correction.

“The crypto market is likely to experience a significant correction as leveraged positions get paid back or are liquidated.”

Bitcoin holders are currently enjoying profitable positions.

The performance of the spot Bitcoin ETFs in the US had a major impact on the price of BTC, which broke several all-time highs in March.

The IntoTheBlock study states that the “average 90-day return for the top 20 crypto-assets (excluding stablecoins) […] is 103%,” pointing to “overheated” conditions.

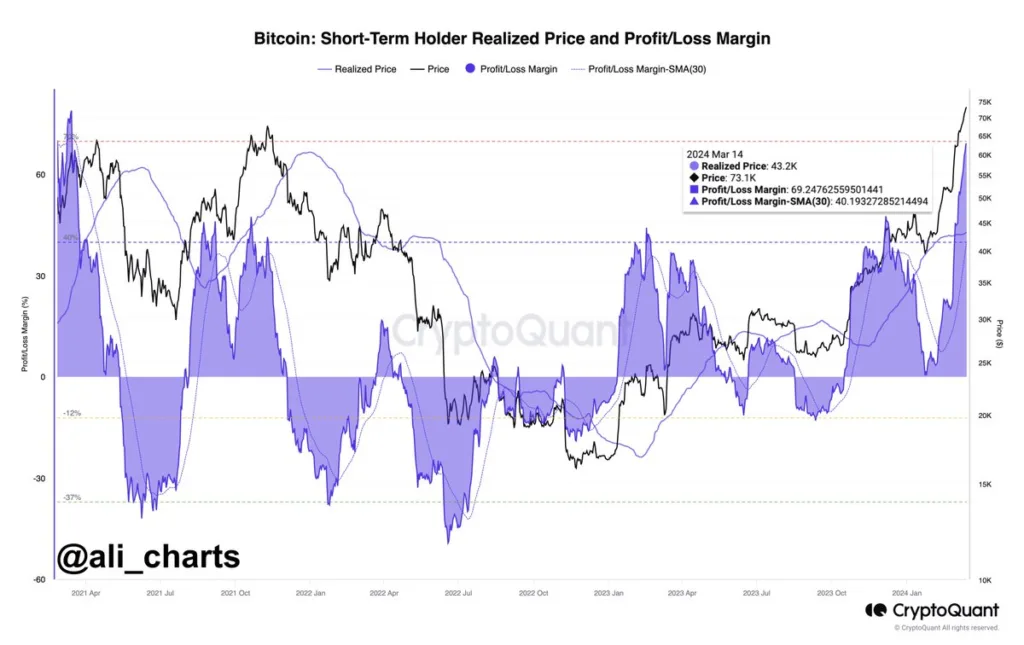

It suggests that the majority of traders have made money off of their cryptocurrency investments. X user named Alie claimed that Investors “are currently sitting on profits of 70% in their holdings,”.

Analyst Ali published the following graphic from CryptoQuant in a post on March 14 on X. It indicates that as the price touched greater highs above $73,000, traders’ unrealized profit margins reached 69%. This is traditionally linked to impending corrections as traders start booking profits.

“This level of unrealized $BTC profits is the highest in the past three years!”

Additional information from IntoTheBlock shows that 86% of all Bitcoin holders are profiting at present levels, raising the prospect of a short-term sell-off as profit-booking continues.