Bitcoin’s price drop of more than 7% in the previous days has resulted in $256 million in losses for traders with lengthy positions. Despite the rising geopolitical tensions in the Middle East, observers think it’s nothing out of the ordinary.

This drop seems to be typical as of now. This cycle, we’ve seen many 20–22% declines,” Benjamin Cowan wrote in a post on X on the 13th of April . Michael Saylor, CEO of MicroStrategy, stated on April 13 on X that “chaos is good for Bitcoin.”

Crypto trader Rekt Capital, who goes by the pseudonym, predicts that the price of Bitcoin will soon start its “uptrend,” but not before suffering some temporary setbacks:

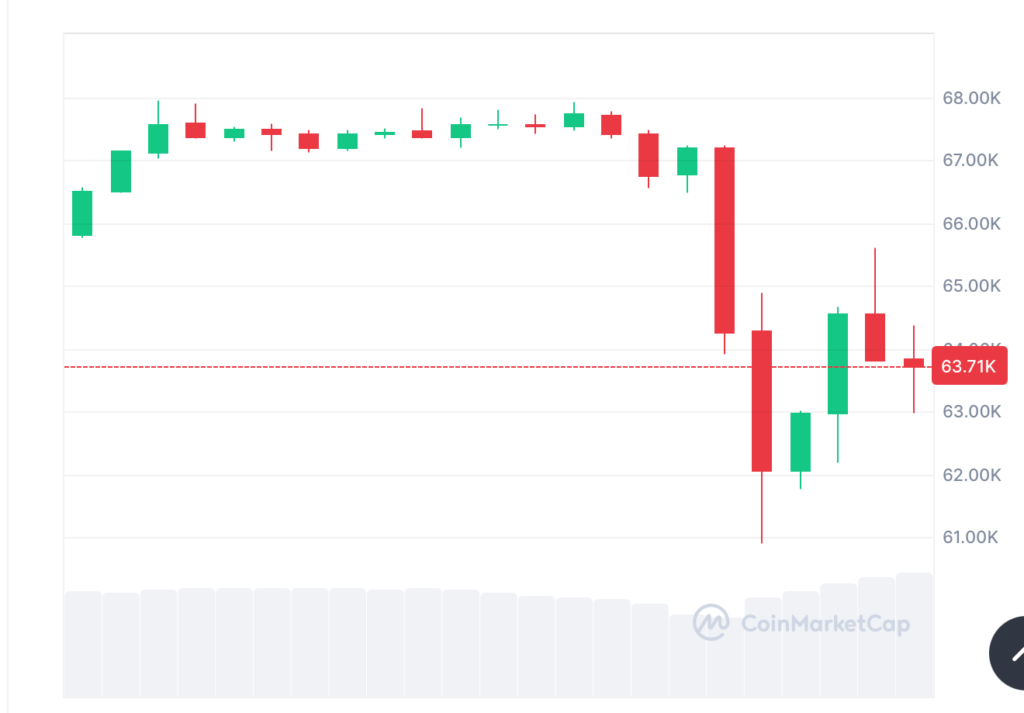

The price of Bitcoin crashed to $60,919 on April 13 before leveling off at $62,060.Its price as of this writing is $63,858, according to statistics from CoinMarketCap.

A sharp decline in prices over the past day has led to liquidations of leveraged Bitcoin positions totaling $319.15 million. Of this total, $256.58 million came from long positions, and $62.58 million came from short ones, according to CoinGlass statistics.

It seems like traders are preparing themselves for the greatest possible drop. If Bitcoin were to revert to its recent high of $67,000, short positions worth $1.05 billion would be at risk of liquidation.

Bitcoin Whales Drive Unprecedented Demand Amid Market Volatility

Though $945.9 million in cryptocurrencies liquidated by 253,554 dealers in the last day, the rest of the market suffered severely. The Crypto Fear and Greed Index which is a measure of emotion in the cryptocurrency market, is currently at 72, a little lower than the severe 78 it was last week.

The value of the entire cryptocurrency market has fallen by 8% to $2.23 trillion. At the same time, Cointelegraph has revealed that there has never been a greater increase in demand from Bitcoin whales.

Data released by the cryptocurrency analytics company CryptoQuant shows that for the first time, demand from “permanent holders” has surpassed the market supply of fresh Bitcoin. This shows that the demand from cryptocurrency investors cannot be satisfied by the amount of new Bitcoin created by mining.